Energy Outlook

April 2025

We are through the first quarter of 2025 and emerging from winter in one piece, if not entirely unscathed. The oil, gas and power markets could be best described as ‘up and down’ over this period, influenced by the weather, the state of gas storage, general economic uncertainty and unstable world events. In this update, we will look at how prices have moved since the beginning of the year, what has driven those changes and what to look out for in the months ahead.

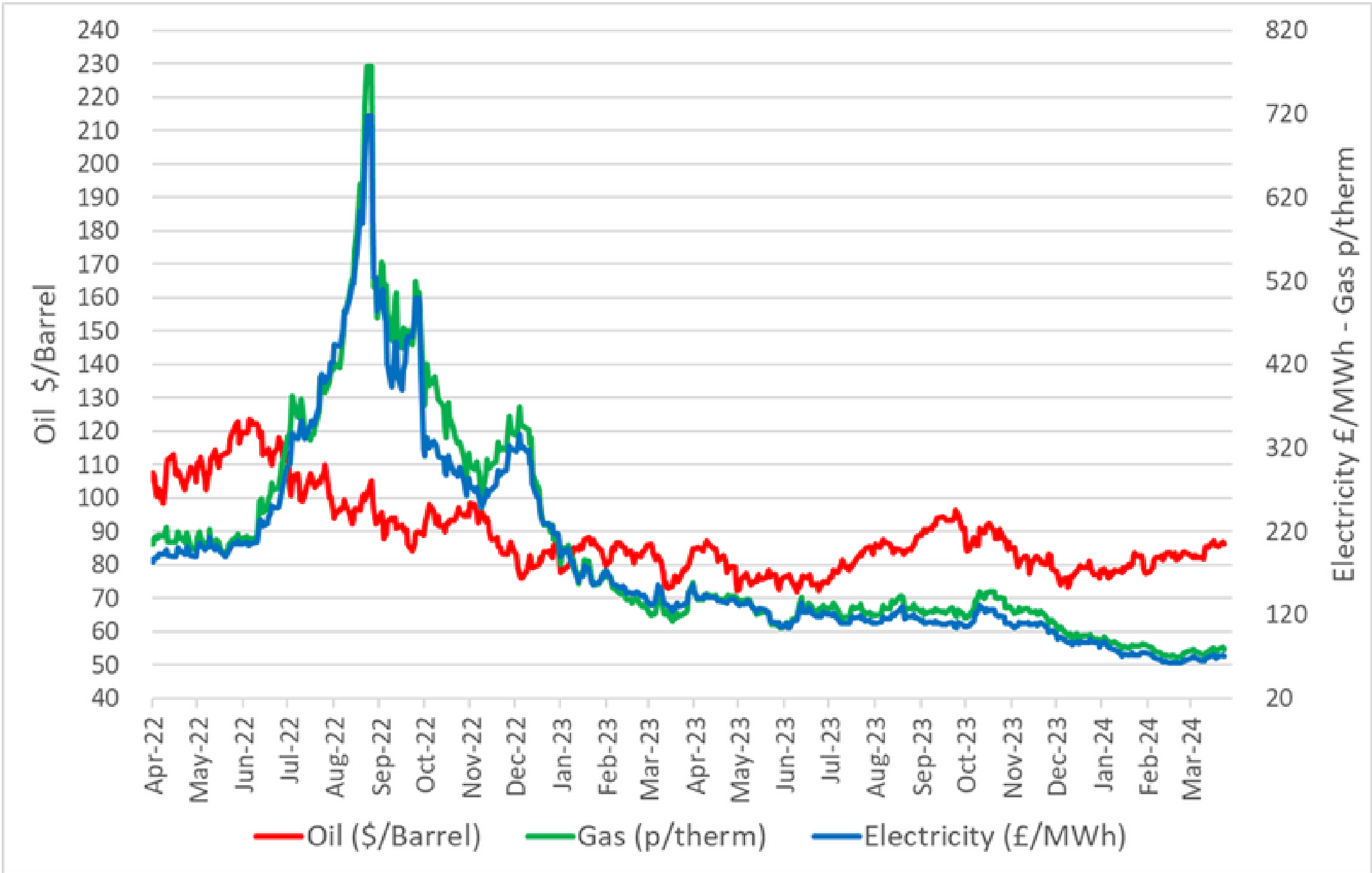

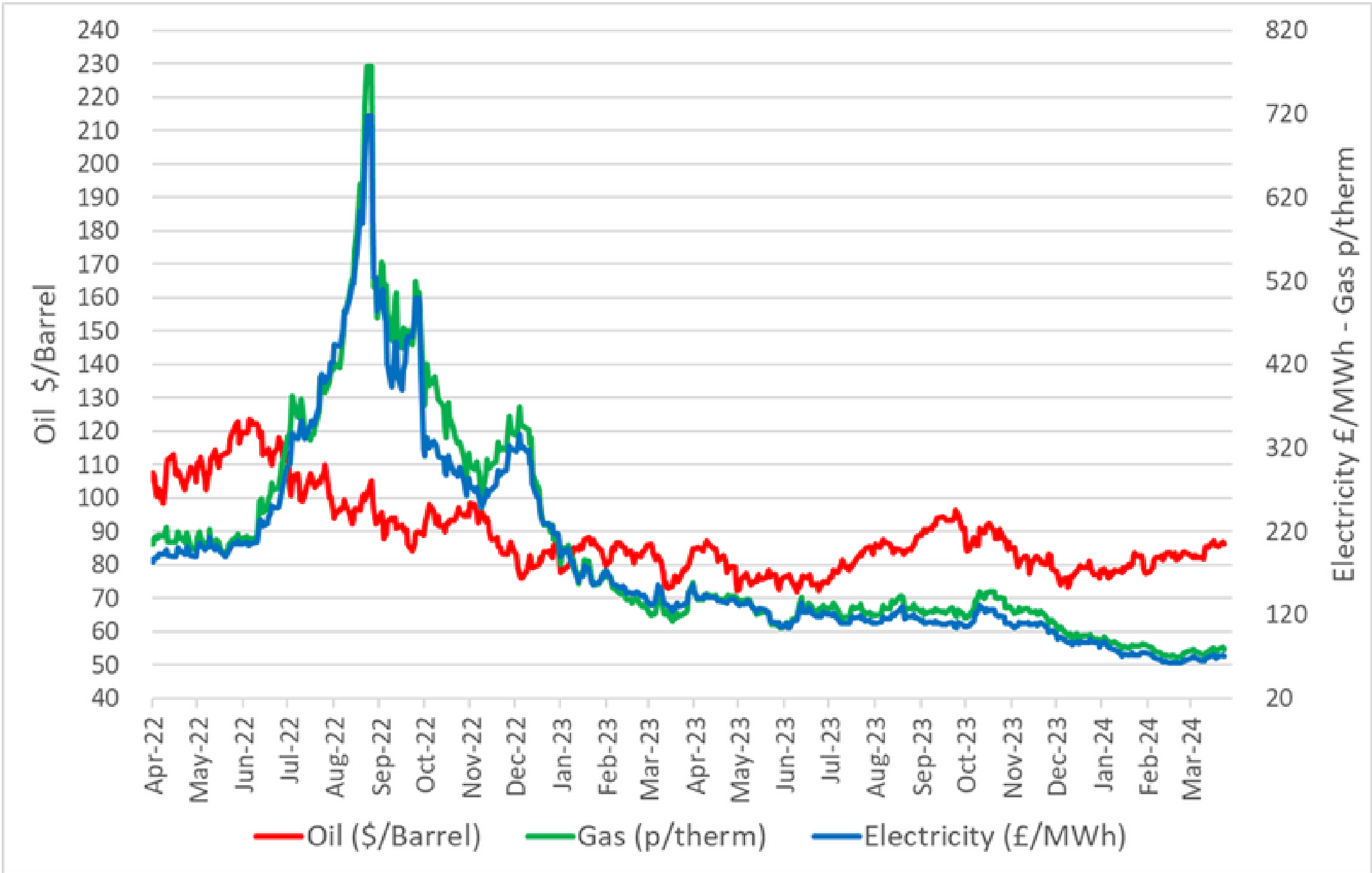

Energy Price History

The chart below illustrates how UK energy prices have developed since early 2023:

Oil prices have bounced between the $70 and $80/barrel mark since the beginning of the year, in many ways reflecting the frenetic first quarter of Donald Trump’s second presidential term. It is becoming clear that the actions of the new American administration will heavily influence the energy markets in the years to come, both directly in relation to energy policy and production of oil and gas, and indirectly through their impact on geopolitics and the global economy. Unfortunately, as some of these actions push prices down and some push prices up, this insight doesn’t give us a clear direction for the market, only a promise of volatility. We can expect world events to continue to have a profound effect on UK energy prices, but we must continue to pay attention to the things in our control. Gas storage in the UK and across Europe now sits at the lowest level for three years, at 34% full – replenishing this before the end of summer will be crucial to surviving another winter.

OIL

Oil prices rose to a peak in January on the back of a perceived tightening of supply with voluntary OPEC cuts in place and continuing sanctions on Russian and Iranian output. After breaching $80/barrel, the bull run couldn’t be sustained, driven down by a combination of actions by the new U.S. government – a triple-whammy of a clear intent to increase production (“Drill, Baby, Drill”), an indication of readiness to relax sanctions on Russia and the threat of tariffs weighing on the outlook for global economic growth. Amongst this, in what seems like a counter-intuitive move, the oil cartel OPEC has decided to lift the production cuts it had previously recommended to its members from April. This is widely expected to result in a ramp-up in production.

Oil prices rose to a peak in January on the back of a perceived tightening of supply with voluntary OPEC cuts in place and continuing sanctions on Russian and Iranian output. After breaching $80/barrel, the bull run couldn’t be sustained, driven down by a combination of actions by the new U.S. government – a triple-whammy of a clear intent to increase production (“Drill, Baby, Drill”), an indication of readiness to relax sanctions on Russia and the threat of tariffs weighing on the outlook for global economic growth. Amongst this, in what seems like a counter-intuitive move, the oil cartel OPEC has decided to lift the production cuts it had previously recommended to its members from April. This is widely expected to result in a ramp-up in production.

GAS

Gas has followed a similar pattern to oil in the first quarter, rising to a peak then falling back. This was initially driven by colder than seasonal average weather, which pushed up heat demand and contributed to the further depletion of storage levels. Although February was also cold, it became clear that ample LNG and Norwegian supplies were going to be sufficient to get us through to spring. The outlook was further softened by the potential for some kind of U.S.-brokered peace deal in Ukraine, which triggered the sharp drop mid-February.

Even a casual observer of world events would be sceptical about the prospect of a lasting peace returning to the region any time soon; however, the U.S. has signalled it is willing to broker a relaxation in sanctions and it is clear that in spite of bluster, Russia is in economic crisis which can most easily be addressed by exporting as much oil and gas as it can as soon as possible. Some analysts in the market are suggesting that this could even go as far as re-starting flows through the Nord Stream pipeline to Germany by the end of the year. More immediately, although there is potential for further drops, these will be stemmed to some extent by the need to replenish gas storage in the UK and across the continent ahead of next winter (and competing with Asian LNG demand to do so), essentially bringing some of next winter’s demand into the summer season.

ELECTRICITY

UK Electricity prices continue to be largely influenced by gas (and this will continue for as long as gas remains the marginal source of electricity generation). Beyond this, it has been a mixed bag for the power market so far this year, with disappointing wind and solar production in the first two months offset somewhat by suppressed UKETS carbon prices, which continue to trade at a discount to European prices. The government has introduced its Planning and Infrastructure Bill which (amongst other things) seeks to expedite clean energy projects through planning approval and the grid connection process. This move is welcome, but it will take some time before the effects become visible.

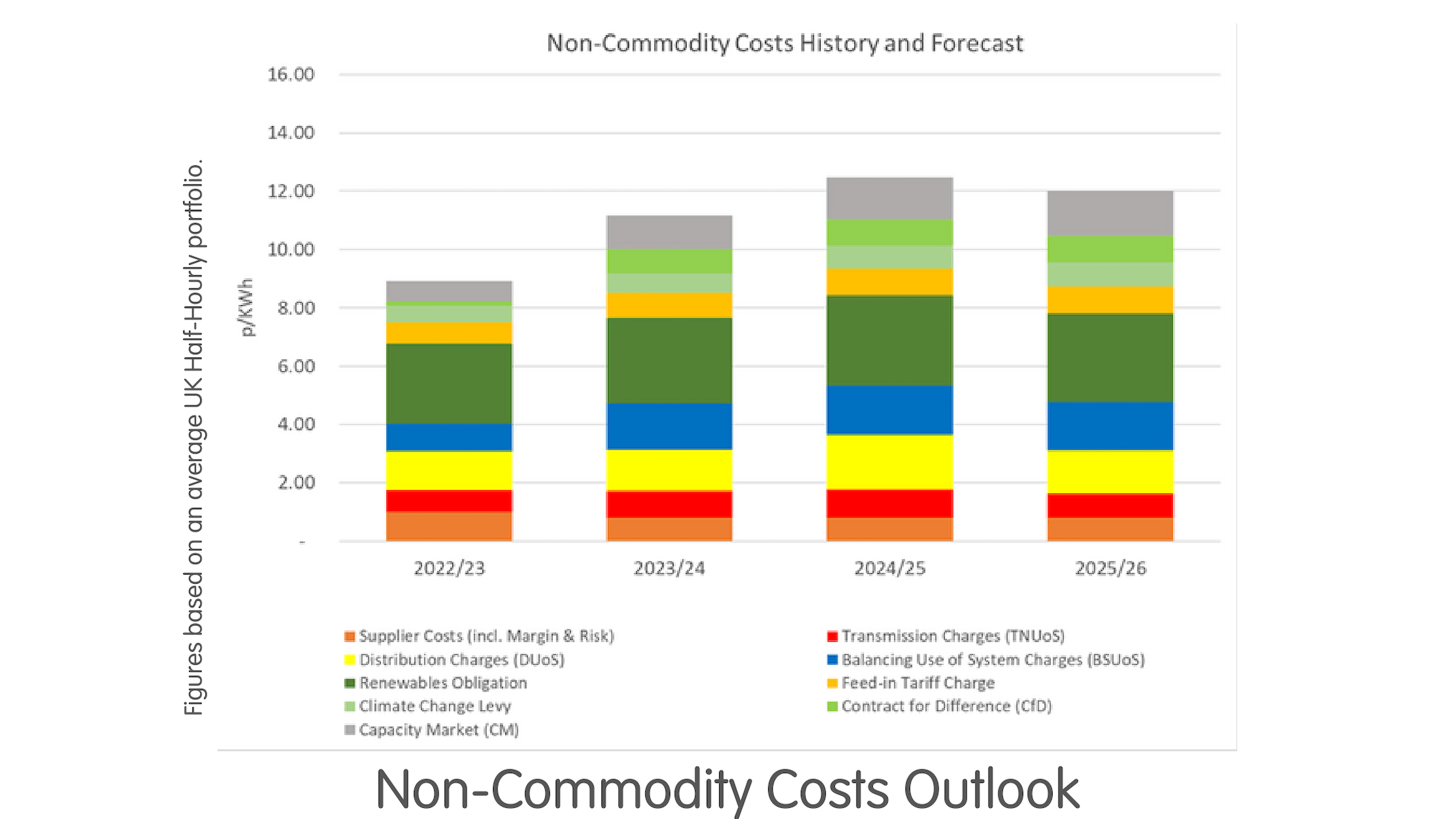

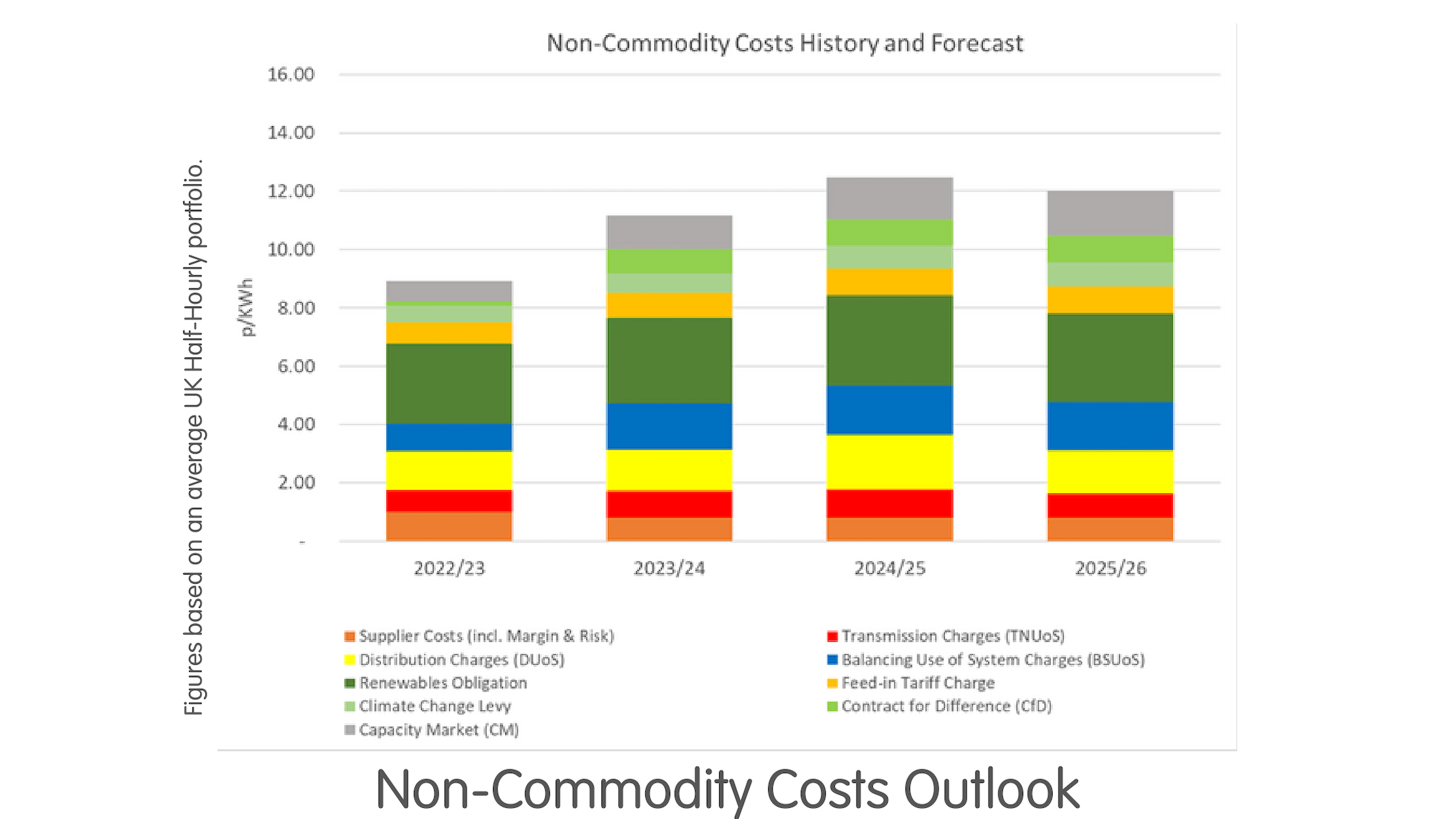

Non-Commodity Costs

Non-commodity costs (sometimes referred to as ‘non-energy charges’ or NECs) are added to bills to cover the costs of the National Grid transmission network, local distribution costs, renewable and environmental surcharges and taxes to ensure security of supply by subsidising the availability of capacity. These add up to around 60% of bills today. The chart below shows the history and forecast charges for an average customer:

Figures based on an average UK Half-Hourly portfolio.

Some of the charges are based on a set formula, whilst others can be variable, depending on market conditions, demand and renewable generation.

Nuclear Regulated Asset Base (RAB) Charges: The government is committed to new nuclear generation capacity, which many consider to be essential to provide the baseload electricity we need without the carbon dioxide emissions of traditional sources of baseload power: coal and gas. To support this, a new charge (RAB charge) will be introduced which will support investment in new nuclear power stations from the build stage onwards. The first project this is due to apply to is the new 3.2GW Sizewell C power plant. The actual charges won’t be known until the Final Investment Decision is made for the plant, which has been delayed multiple times but now expected in June. The Department for Energy Security and New Zero (DESNZ) has so far failed to provide a forecast cost in customers’ bills; however, we estimate that the initial impact will be around 0.03p/kWh initially, but could rise to 0.5p/kWh by the time it becomes operational.

REMA (Review of Electricity Market Arrangements): A major review of the market is considering changing the current national wholesale market into multiple regional (or ‘zonal’) markets to reflect the balance of localised generation and supply.As this complex proposal evolves, we will provide further details on the potential impact and any preparations needed by customers.

For more information, please get in touch with your Utility Aid Account Manager or call us on 0808 1788 170

DISCLAIMER – This Outlook Paper is provided for information purposes only and may include opinions expressed by Utility Aid Ltd (“UA”) which are not guaranteed in any way. UA does not represent or warrant that the information provided to you is comprehensive, up to date, complete or verified, and shall have no liability whatsoever for the accuracy of the information or any reliance placed on the information or use made of it by any person or entity for any purpose. Nothing in this Outlook Paper constitutes or shall be deemed to constitute advice or a recommendation to engage in specific activity or enter into any transaction.

Oil prices rose to a peak in January on the back of a perceived tightening of supply with voluntary OPEC cuts in place and continuing sanctions on Russian and Iranian output. After breaching $80/barrel, the bull run couldn’t be sustained, driven down by a combination of actions by the new U.S. government – a triple-whammy of a clear intent to increase production (“Drill, Baby, Drill”), an indication of readiness to relax sanctions on Russia and the threat of tariffs weighing on the outlook for global economic growth. Amongst this, in what seems like a counter-intuitive move, the oil cartel OPEC has decided to lift the production cuts it had previously recommended to its members from April. This is widely expected to result in a ramp-up in production.

Oil prices rose to a peak in January on the back of a perceived tightening of supply with voluntary OPEC cuts in place and continuing sanctions on Russian and Iranian output. After breaching $80/barrel, the bull run couldn’t be sustained, driven down by a combination of actions by the new U.S. government – a triple-whammy of a clear intent to increase production (“Drill, Baby, Drill”), an indication of readiness to relax sanctions on Russia and the threat of tariffs weighing on the outlook for global economic growth. Amongst this, in what seems like a counter-intuitive move, the oil cartel OPEC has decided to lift the production cuts it had previously recommended to its members from April. This is widely expected to result in a ramp-up in production.